46+ does applying for a mortgage hurt your credit

Web How a Mortgage Affects Your Credit. A refinanced home loan could show up on your credit report as a new loan which means it brings down the average.

Does Refinancing Hurt Your Credit Score

Although a preapproval may affect your credit score it.

. Web A mortgage preapproval can have a hard inquiry on your credit score if you end up applying for the credit. You only earn so much money so. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

Web Making payments before the end of your billing period can help you keep your credit utilization low. Web Once your complete your mortgage application your lender will check your credit report at all three of the major US. Opening a new credit card or loan can.

Web Mortgage application and pre-approval can affect your credit score but the impact is usually minimal. This type of credit check. Web A mortgage preapproval is a document from a lender indicating how much money that lender would allow you to borrow to purchase a home.

Pre-Quality For A Mortgage And Move Into Your Dream Home By Comparing Excellent Lenders. Ad Get Preapproved Compare Loans Calculate Payments - All Online. Dont apply for new accounts.

Apply Online Get Pre-Approved Today. Ad Get Preapproved Compare Loans Calculate Payments - All Online. Web If your home loan has been finalized and funded you may deem it safe to apply for a new credit card account.

Web Keep in mind however that refinancing a mortgage does come with closing costs including an origination fee appraisal costs title insurance and credit reporting. It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. Ad Compare Best Mortgage Lenders 2023.

Your credit report measures your ability to pay back debts. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. After you purchase your new home and close on.

Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web A mortgage pre-approval affects a home buyers credit score.

Pre-Quality For A Mortgage And Move Into Your Dream Home By Comparing Excellent Lenders. The pre-approval typically requires a hard credit inquiry which decreases a buyers credit score. Web You can shop around for a mortgage and it will not hurt your credit Within a 45-day window multiple credit checks from mortgage lenders are recorded on your.

When you apply for a mortgage auto loan personal loan or any other. Web Any application for a loan or credit will have an impact on your credit explains Melinda Opperman president and chief relationship officer of the nonprofit. Save Real Money Today.

When you submit multiple loan applications within a short period of time. Applying for loans will affect your credit score negatively for a short period of time. Web Average Age of Your Credit History Matters.

What Credit Score Is Needed To Buy A House

Mortgages When A Co Borrower Has Poor Credit The New York Times

.webp)

Does Applying For A Mortgage Hurt My Credit

How To Get A Mortgage With 9 Important Steps Credible

Will Paying Off Your Mortgage Hurt Your Credit Credit Com

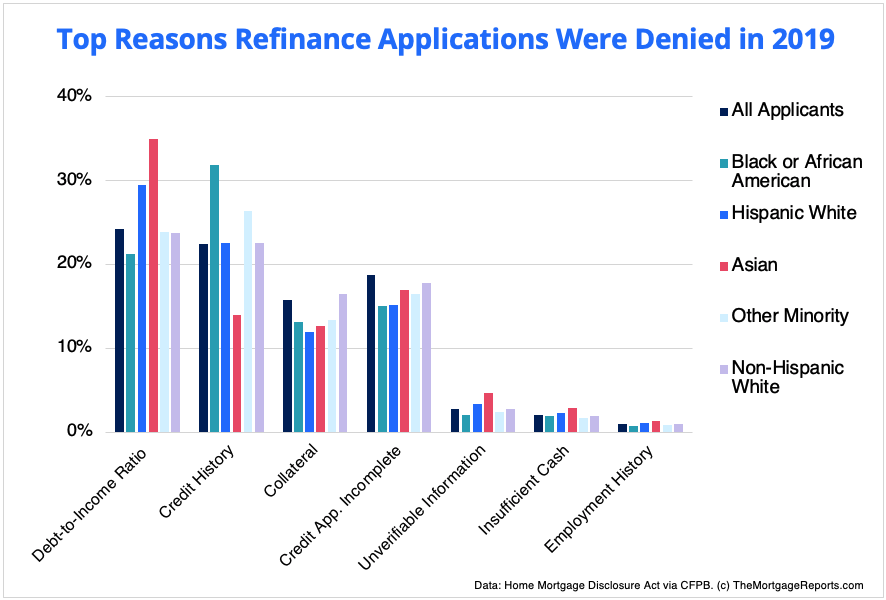

Mortgage Denial Stats By Race What We Can Learn Mortgage Rates Mortgage News And Strategy The Mortgage Reports

46 Southgate Houses For Sale Zolo Ca

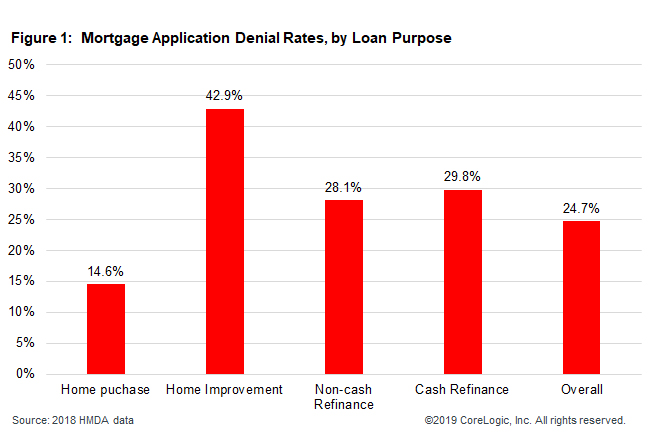

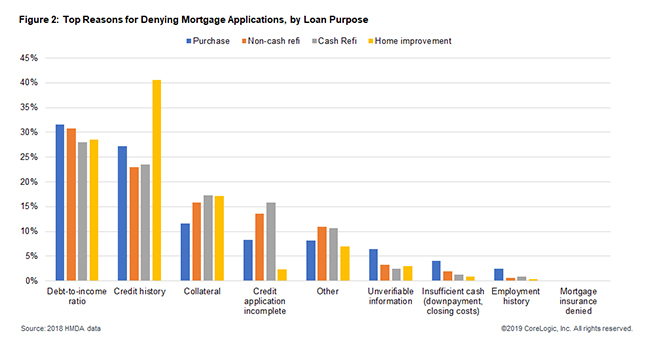

The Top Two Reasons Mortgage Applications Were Denied In 2018 And How To Avoid Them Mortgage Rates Mortgage News And Strategy The Mortgage Reports

![]()

Does Applying For A Loan Hurt My Credit Score Nerdwallet

Free 10 Loan Payment Contract Samples In Pdf

46 Credit Score Statistics And Faqs For 2022 Screen And Reveal

Buying A House Can Depress Credit Scores How Long It Takes To Recover

Does Applying For A Mortgage Hurt My Credit

Do Mortgage Inquiries Affect Your Credit Score Yes But You Can Still Shop

Mortgage Broker Camberwell Balwyn Canterbury Mortgage Choice

Report House Committee On Ethics U S House Of Representatives

Why Mortgage Applications Get Rejected What To Do Next